As we bid farewell to 2023 and embrace the new year, the annual ritual of setting resolutions is upon us. Amidst the reflections, many people are also engaged in the task of reviewing their past year's finances and contemplating ways to trim their impending tax bill. For most, the scramble to gather various forms and tax-related documents is an all-too-familiar new year frenzy—resulting in stress and little time to strategize.

This blog highlights five proactive steps you can take throughout the year to transform the tax season from a stressful ordeal into a more manageable one. Let's explore how you can make tax planning a smoother journey, allowing you to take control of your financial destiny.

1. Understand your tax bracket

To effectively plan for the future, it’s important to know where you are today and where you might be in the future. Understanding your tax bracket is important as it helps you make informed financial decisions and plan more effectively.

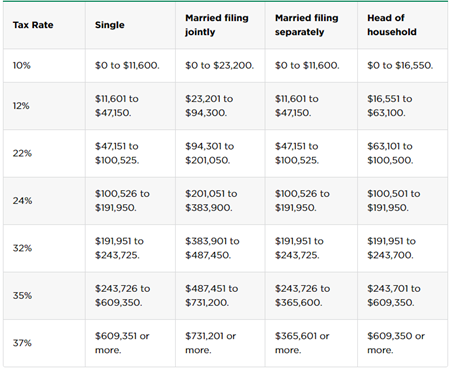

How do you know what tax bracket you will likely be in? U.S. taxpayers are subjected to a progressive tax system. This system imposes higher tax rates on individuals with higher taxable income and lower rates on those with lower taxable income. Currently, there are seven income tax brackets with corresponding income ranges that are determined by your filing status.

2024 tax brackets and federal income tax rates

Source: Internal Revenue Service. Rev. Proc. 2023-34. Accessed Dec 20, 2023.

Regardless of your tax bracket, it's unlikely you'll pay the designated rate on your entire income. This is due to two primary reasons:

- Your taxable income is different than your earned income. Taxpayers have the opportunity to subtract tax deductions from their total income. For this reason, your salary or total income will most often be higher than your taxable income.

- You don’t typically multiply your taxable income by the corresponding tax bracket. Our tax system is a graduated system similar to climbing a set of stairs.

2. The difference between tax deductions and tax credits

The utilization of tax deductions and tax credits can be one of the easiest ways to reduce your tax bill. However, to use them effectively, it’s important to understand the difference between the two:

- Tax deductions refer to eligible expenses that you can deduct from your taxable income. They reduce how much of your income is subject to taxes.

- Tax credits give you a dollar-for-dollar reduction in your tax bill. Tax credits can have a significant impact on your final tax bill.

3. Should you itemize or take the Standard Deduction?

The Standard Deduction guarantees that every taxpayer has a certain amount of income exempt from federal income tax. Generally, you can choose between taking the Standard Deduction or itemizing your deductions, but both cannot be claimed in the same tax year.

Itemization is attractive for individuals whose individual deductions surpass the Standard Deduction. It becomes particularly appealing for those who have incurred substantial expenses in charitable contributions and mortgage interest expenses throughout the tax year. The downside of itemizing is that it requires more time for tax preparation, and you must be able to provide documentation you qualify for the deductions.

4. Sheltering income

If you anticipate transitioning to a lower tax bracket in the future, it could be beneficial to optimize your current tax deductions by leveraging various pre-tax savings options. Since taxes are not typically paid on pre-tax contributions, the associated tax obligation is essentially deferred until the funds are withdrawn, with the exception of withdrawals from Flexible Spending Accounts (FSAs), Health Savings Accounts (HSAs) and 529 accounts designated for qualified expenses. Contributing to the following accounts results in a reduction of your taxable income for the year in which the contributions are made:

- Traditional 401(k)

- Traditional Individual Retirement Account (IRA)

- Traditional 403(b)

- SIMPLE IRA

- SEP IRA

- FSA

- HSA

For this reason, it is important you understand your current tax rate as well as the impact that withdrawals from pre-tax accounts will have on your tax bracket in the future.

5. Utilize tax efficient investment strategies

You can also minimize tax by making tax-conscious investment choices. Although income is generally taxable, certain investments generate income that's exempt from tax at the federal or state level. Also, you can exclude the interest on certain municipal bonds from your federal income. Keep in mind that although the interest on municipal bonds is generally tax exempt, certain municipal bond income may be subject to the federal alternative minimum tax. When comparing taxable and tax-exempt investment options, you'll want to focus on those choices that maximize your after-tax return.

The amount of time you hold an asset before selling it can make a big tax difference. In most cases, long-term capital gain tax rates are lower than ordinary income tax rates. Long-term capital gain rates generally apply when an asset has been held for more than a year; you may find it makes good tax-sense to hold off a little longer on selling an asset that you've held for only 11 months. Timing the sale of a capital asset (such as stock) can help in other ways as well. For example, if you expect to be in a lower income tax bracket next year, you might consider waiting until then to sell your stock. If you have capital losses this year that you can use to offset a resulting gain, you may want to accelerate income into this year by selling appreciated assets.

Note: You should not decide which investment options are appropriate for you based on tax considerations alone. Nor should you decide when (or if) to sell an asset solely based on the tax consequence. A financial or tax professional can help you decide what choices are right for your specific situation.

Summary

At its core, tax planning involves strategically timing income and deductions to optimize your overall tax outcome. This could mean delaying the receipt of income to the next year, thus deferring the associated tax liability, and accelerating deductions into the current year. The most suitable tax planning strategies depend on your specific financial circumstances.

The specialists at Busey Wealth Management can help you create a roadmap for the future created for your unique financial situation. To learn more, visit busey.com/wealth-management.

This is not intended to provide legal, tax or accounting advice. Any statement contained in this communication concerning U.S. tax matters is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties imposed on the relevant taxpayer. Clients should obtain their own independent tax advice based on their particular circumstances.

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

This presentation is for general information purposes only. It does not take into account the particular investment objectives, restrictions, tax and financial situation or other needs of any specific client.

Investment products and services through Busey Wealth Management are:

Not FDIC INSURED | May lose value | No bank guarantee